Equity indexed universal life insurance can be a great solution for any life insurance situation; however, indexed life makes the most sense when there is need for cash value accumulation, flexible life insurance options, low cost guaranteed death benefits, and tax managed retirement planning.

Cash Value Accumulation

A primary reason to buy equity-indexed life insurance is its ability to grow and accumulate cash values tax deferred without risk of downside loss. The indexed account feature of equity indexed insurance allows the policyholder the option of indirectly participating in the upward movement of a stock index without accepting the normal risk associated with investing in the stock market. Cash values allocated to the indexed option have the potential for higher interest credits than a traditional universal life policy without the potential risk of loss inherent in variable universal life insurance. The combination of tax deferred cash value growth and the ability to earn higher interest credits without risk of loss makes the equity indexed universal life insurance policy a sound choice for anyone seeking to accumulate cash.

Flexible Life Insurance Options

A second reason to consider indexed universal life is policy flexibility. The flexible policy options of indexed universal life include adjustable policy premiums and the ability to increase or decrease coverage amounts.

The unique policy design of equity indexed universal life insurance allows policyholders to pay premiums on a flexible, non-scheduled basis. Depending on policy minimums, the policy owner can choose the timing of premium payments as well as the amount of the premium. In other words, as long as there is sufficient cash value to cover policy costs, the policy owner has the option of paying the minimum premium, no premium or the maximum policy premium subject to insurance company and IRS guidelines. The capability to adjust premium payments based on changing circumstances gives the policyholder the flexibility to buy the amount of insurance needed today while at the same time providing an option for future premium increases.

Additionally, with equity indexed universal life, insurance coverage amounts may be adjusted up or down subject to certain policy minimums and maximums. If the face amount of the policy is increased, the company will require proof of good health and there must be enough cash value in the policy to cover the additional insurance costs associated with the increase. If the insurance amount is decreased, a minimum amount of term insurance is required to be maintained to meet the IRS guidelines for life insurance. The ability to adjust insurance face amounts gives a policyholder options that are not available in most other life insurance policies.

Low Cost Guaranteed Death Benefits

Most equity indexed life policies provide for a guaranteed minimum death benefit for at least the first fifteen policy years depending upon the age of the insured when the policy is issued. Additionally, some companies include the option to guarantee the insurance coverage for the lifetime of the insured. The guaranteed death benefit is subject to a minimum premium that must be paid in order to keep the policy in force. As long as the minimum premium is paid in a timely fashion, the life insurance amount will be guaranteed based on the terms of the specific insurance policy. The option to extend the guaranteed death benefit period to a lifetime guarantee will require additional costs and will have the impact of reducing the upside growth potential of the cash values. If lifetime guaranteed coverage is important, a comparison of equity indexed universal life insurance and traditional universal life insurance is warranted. In most cases, universal life will offer a more competitive rate but there are some equity indexed life policies that are extremely competitive with respect to guaranteed death benefits. Get an instant lifetime guaranteed universal life insurance quote.

Tax Managed Retirement Planning

The equity indexed life insurance policy provides an excellent tax efficient funding vehicle for growing cash values that can later be accessed in retirement. As is the case with most cash value insurance policies, indexed life offers unique tax advantages that if utilized properly can result in more retirement income with reduced taxes. Cash values in equity indexed universal life insurance policies accumulate tax deferred and may be accessed tax-free at retirement subject to certain limits.

Depending on the terms of the policy, cash values may be accessed tax free via withdrawals or partial surrenders up to the basis of the policy. The policy basis is the total amount of policy premiums paid to date. Any withdrawal or partial surrender up to the basis is considered return of premium and no taxes are payable. Any withdrawals beyond the policy basis would be subject to income taxation. A withdrawal or partial surrender will have the impact of reducing the insurance death benefit by an equal amount as the surrender.

Once withdrawals have been taken up to the policy basis, a tax free policy loan can be used to access cash values. When a policy loan is made, funds are actually borrowed from the insurance company and a reasonable interest rate of 6-8% annually is charged. Loan interest will accrue until the loan is repaid. While the loan is accruing interest, the policy cash values are also getting credited with an interest rate based on the prevailing rate, currently 3-5% with most companies. Therefore, there is a net loan rate, which is the difference between the actual interest rate charged by the company less the current credited rate on the policy cash value. Currently net loan rates are somewhere between 2-4%. After the first five policy years and subject to certain conditions, many companies offer preferred loans which have a net loan rate of 0%. Preferred loans were created specifically for retirement income planning.

As long as the policy retains enough cash value to pay insurance costs and fees, taxes can permanently be avoided using the withdrawal to basis then policy loan approach to retirement income planning. If however, the policy lapses due to lack of cash to pay policy costs, all cash received from the policy in excess of the policy basis will be subject to income taxes. Policy loans do not have to be repaid as the loan amount with interest can be deducted from the policy face amount at death. For more information on taxes and life insurance see, “Life Insurance Tax Advantages".

More Reasons Why you should Buy

Equity Indexed Life Insurance can be the key component in a sound financial plan. With EIUL you reap the rewards of stock market gains at the same time you’re protected by minimum guaranteed interest rates.Equity Indexed Annuity offers security and a guaranteed rate of return, (backed by a life insurance company), 3% a year is the common guaranteed rate. Equity-indexed annuities have two common features intriguing to investors.

| 1. | They are almost as safe as certificates

of deposit, however in addition to being secure

they have the added benefit of offering the investor

the opportunity to capture some of the stock market’s

future gains. |

| 2. | Another positive feature of equity indexed annuities is because they typically lock up an investors cash for six to seven years, this feature gives investors the advantage of delaying paying taxes on income earned within the account, since the account’s income is only taxed in the years you withdraw money |

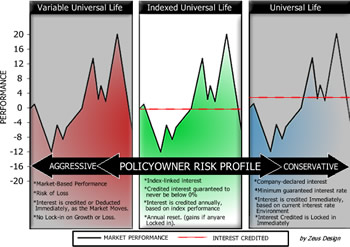

As the chart below shows, the real value of the equity indexed universal life policy is its ability to earn a credited interest rate higher than a traditional universal life insurance policy without accepting the risk of loss associated with the variable universal life policy. The equity indexed universal life policy is designed to capture the best elements of both the fixed whole life and the variable life policies enabling it to earn an acceptable “middle of the road interest rate” without taking on unnecessary risk.

Please Click on the picture for a larger view